Cloud algotrading platformfor stocks & stockpicking

Trade with Confidence - Beat the index, minimize drawdowns and get stable results

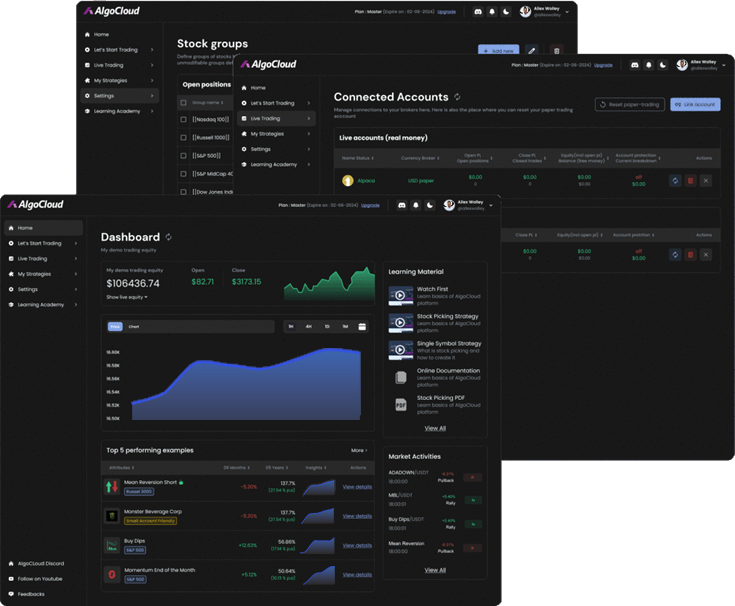

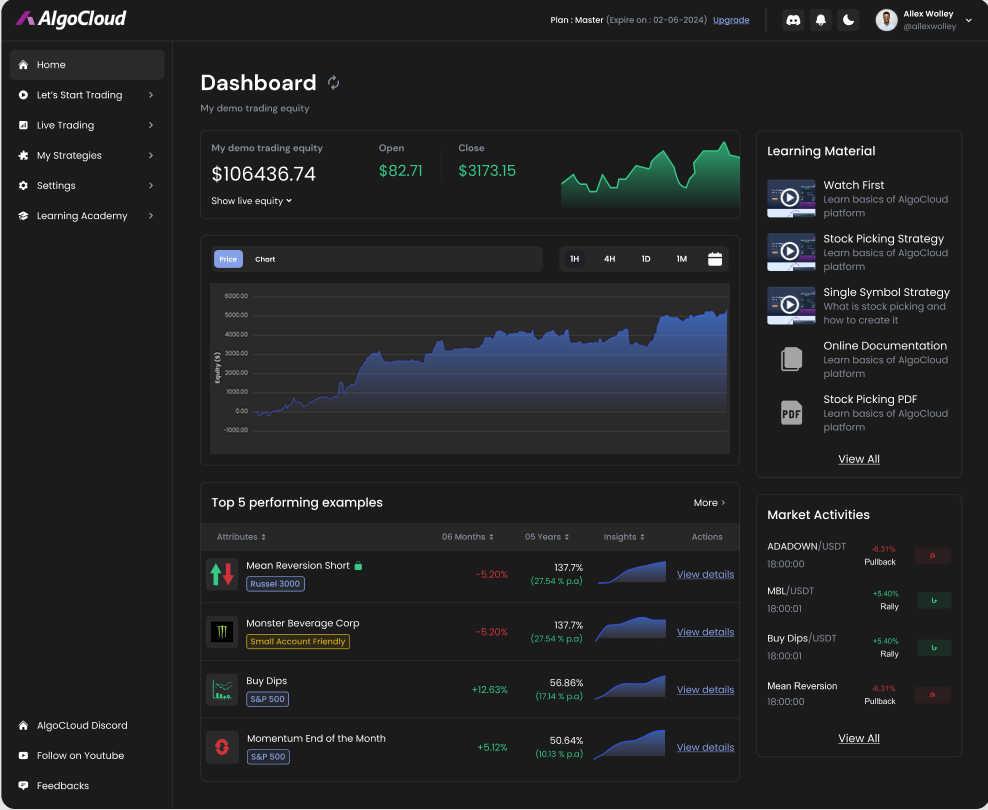

No-code platform for every trading level

AlgoCloud easy-to-use interface gives every user a posibility to develop and deploy their own stock algo strategies on a cloud, to be executed automatically.

Experienced Algo traders

Find powerful development & research tools to get your trading to the next level.

Experienced Manual Traders

Automatize your trading strategies and let cloud trade for you 24/7.

Passive Investors

Diversify your investments with simple, but powerful time-proven algo strategies.

Non-experienced Beginners

Learn your way to algo trading with simple, yet powerful stock strategies.

Beat the index with AlgoCloud easily implement strategies with market edge

AlgoCloud platform allows you to create, backtest and deploy various types of stock algo strategies, exploiting market inefficiencies, working on all types of markets.

Trade under the radar

Trade under the radar of institutions and hedge funds, exploit opportunities that are too small for them.

Stockpicker strategies

Pick only the best stocks from index, instead of buying it whole - you'll be surprised what it can do to profitability.

Small Account Strategies

Pattern Day Trading rule affects people who cannot afford big account. AlgoCloud lets you develop strategies also for small accounts.

Seasonal strategies

Deploy strategies that use seasonal edge like end of the month, summer, Christmas.

Start with AlgoCloud in 3 steps

-

1. Create strategies using no-code editor

Build algo strategies visually in your browser, no programming involved.

-

2. Backtest them using of 30+ years institutional quality data

Reliable backtest engine on high quality data from leading institutional data providers.

-

3. Connect your broker and trade your strategies live in cloud

Let your algo strategies trade effortlessly and automatically on the AlgoCloud

A clean & easy to use experiencewith Bden Finance.

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et

-

See Analytics

Ipsum has been the industry's standard dummy text ever since the 1500s.

-

Payment Statements

Ipsum has been the industry's standard dummy text ever since the 1500s.

-

Secured with 2FA

Ipsum has been the industry's standard dummy text ever since the 1500s.

-

Developer's API

Ipsum has been the industry's standard dummy text ever since the 1500s.

-

Easily Managable account

Ipsum has been the industry's standard dummy text ever since the 1500s.

-

Verify & Start Transaction

Ipsum has been the industry's standard dummy text ever since the 1500s.

Supported Broker connections

Watch AlgoCloud In Action

Watch the demonstration of AlgoCloud platform